Top Guidelines Of Certified Accountant

Wiki Article

The Basic Principles Of Accounting Fresno

Table of ContentsNot known Facts About Certified AccountantSome Ideas on Certified Accountant You Need To KnowAccountants Can Be Fun For AnyoneThe Definitive Guide for Fresno CpaExamine This Report on Certified Cpa

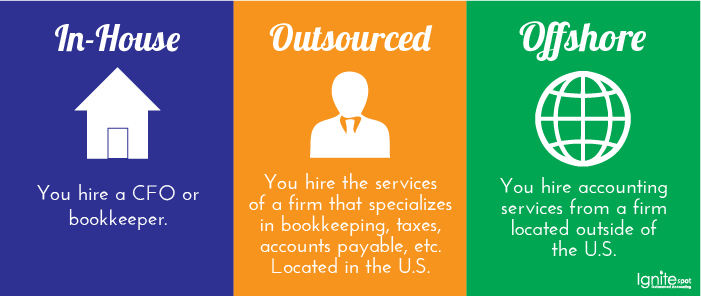

At the end of the month into newly reconciled financial institution accounts and also a fresh collection of financial documents. After your last accounting professional placed in their notice. If you notice you may be paying way too much for an in-house accountant. Outsourcing your accounting professional can help you maintain your company agile no matter what economic or social adjustments take place around you.We have all of the experience you're looking for from pay-roll to organization development that can aid your company thrive.

:max_bytes(150000):strip_icc()/accountingperiod_definition_0929-20fc49a7325e4ce7b4975caca2683c1e.jpg)

Certified public accountants are accounting professionals who are tax obligation professionals. Prior to you begin your organization, you need to satisfy with a certified public accountant for tax guidance on which service structure will conserve you cash and also the audit approach you must use. If you're examined, a certified public accountant can represent you prior to the IRS.As a small company proprietor, you might find it hard to assess when to outsource duties or handle them on your own.

While you can certainly care for the daily accountancy on your own particularly if you have good accountancy software application or employ an accountant, there are circumstances when the expertise of a CPA can assist you make sound business choices, stay clear of expensive mistakes and conserve you time. CPAs are tax obligation professionals who can file your service's taxes, response essential monetary concerns as well as potentially conserve your business cash.

Fascination About Accountants

This implies Certified public accountants are legally required to act in the most effective interest of their clients, whereas a conventional accounting professional does not have a license to shed. A CPA is also an accounting professional, but just about 50% of accountants are additionally certified Certified public accountants. CPAs can use lots of hats for your small company.

g., tax obligation papers and profit-and-loss declarations), financial preparation as well as tax obligation filing, to name a few tasks. They can likewise provide sound financial recommendations for your company as you remain to expand, so you can focus on running your service. These are the general duties you can expect from a CERTIFIED PUBLIC ACCOUNTANT: Certified public accountants are certified to handle every one of your business tax demands, including year-round recordkeeping and also filing tax expansions with the IRS.If you are examined, CPAs can decrease the cost of audit findings by working out with the internal revenue service in your place.

CPAs can aid you with important financial choices, spending plans, economic danger management troubles, and also various other monetary solutions. They can likewise offer beneficial guidance on difficult economic matters. CPAs can help monitor your books as well as stop fraud. If you're not currently utilizing leading payroll software program, Certified public accountants can establish your company up with a platform that helps your firm.

5 Simple Techniques For Certified Cpa

In enhancement to bookkeeping as well as pay-roll, a CPA assists with tax obligation guidance, preparation and compliance. The short solution is that it depends largely on your company and also the services you require.It is necessary to have an idea of the type of solutions you require prior to you meet a possible CPA. In this manner, you can have a clear conversation on exactly how they are mosting likely to bill you. By itemizing prices, you can obtain a realistic idea of exactly how the certified public accountant can help your company grow.

While it's hard to determine a concrete number for just how much you can anticipate to pay a CPA, it is very important to have an understanding of normal costs and also expenses. These are some regular expenditures to review before you consult with a CPA: Hourly rates, Administrative fees, Paperwork fees, Other fees and solutions read The nationwide mean wage for a certified public accountant is $40 per hour.

You do not always require to employ a CPA as a full time or perhaps part-time employee to gain from their expertise of the ins and also outs of service financing, as lots of provide their solutions as specialists. These are times you ought to consider working with a CPA: When you're releasing an organization and also money is tight, the concept of paying thousands of dollars for a few hrs with a CPA may seem extravagant.

The Basic Principles Of Accountants

A Certified public accountant can aid you establish up your service so you can prevent costly mistakes.

CPAs can prepare tax obligation records, documents income tax return, and strategize means to decrease your tax obligation responsibility for the list below year. Certified public accountants can represent you if the Internal revenue service has inquiries regarding your return or if you or your company are audited, which is a vital factor to consider. Service taxes are different from individual taxes; also if you have actually always done your tax obligations on your own, you may wish to employ a certified public accountant if your tax situation is complicated.

These are various other methods CPAs can assist you with your taxes: CPAs aid you recognize as well as follow tax changes. When the tax obligation code modifications, such as it finished with the Tax Obligation Cuts and also Jobs Act, a certified public accountant can help you understand if and exactly how the modifications influence your service.

Certified Accountant Can Be Fun For Everyone

While you intend to take as lots of deductions as you're qualified to, you likewise don't wish to make questionable reductions that might trigger an audit. A CPA can help you make a decision when you need to or should not take particular deductions - accounting fresno. These are some instances when you might require a CPA's suggestions: You're starting a business and require to know which startup prices are deductible.

Your residence as well as small company intermingle, as well as you're not certain which important source costs are insurance deductible. As an example, can you subtract your house workplace if you likewise have a workdesk at another place? If your lorry is primarily utilized for work, should you or your service possess it? Is your mobile phone a service expense? If you take a company journey and also expand it for a few holiday days, which expenses can you deduct!.?. !? As you run your company, there may specify circumstances when you require a certified public accountant's proficiency.

CPAs have experience dealing with the internal revenue service as well as can aid you react read review properly, supply the details it requires, as well as solve the issue as painlessly as possible. These are some various other circumstances that might trigger you to hire a CERTIFIED PUBLIC ACCOUNTANT: If you're assuming about taking out a bank loan, a certified public accountant can assist you make a decision if funding fits your long-term goals.

Report this wiki page